Your home and Real estate can be an extremely lucrative investment, and when ready to sell and make a move, whether it’s your primary residence or an investment property, knowing precisely what you’re up against and how to define the bottom line means there’ll be no unknown surprises when it comes down to what you actually profit off the sale of your home.

The closing costs in California can vary, but generally, California homeowners can expect to pay somewhere between 6 to 10 percent of your home’s selling price to close the deal, also known as escrow.

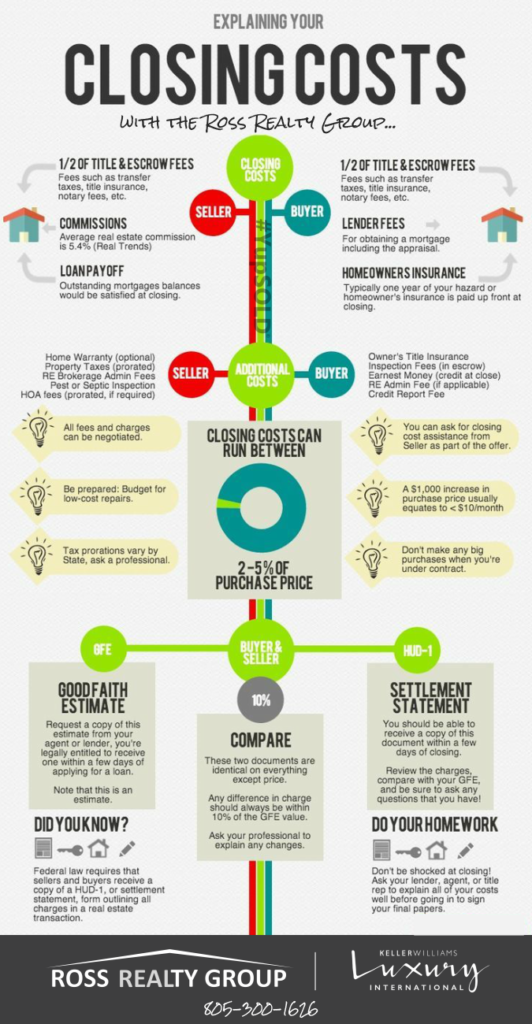

Factoring in closing costs – the additional charges outside of normal real estate commissions – is an important step in the process. There’s quite a bit more to it than just subtracting your loan balance from the contracted purchase price. Naturally, as long as your home has built up enough equity (meaning, it’s worth more today than what you paid for it), most sellers will not have to come up with additional cash to cover the costs listed below. If you’re upside down on your home (meaning it’s worth less than today than your initial purchase price, then in all likelihood, it’s going to cost you to sell it.

Minimal fees and costs add up quick. What, precisely are the typical closing costs for sellers in California? From the real estate commission paid to the buyers and listing agents, to escrow fees to city or county transfer fees, when it comes to seller closing costs in California, you as the homeowner needs to know what to expect before listing your home.

1. Listing agent commission

As the seller, you pay the listing agent commission if you use a listing agent to sell your home. The investment is generally 2.5% – 3% of the total home sale. However, commissions are negotiable, so don’t be afraid to talk to your agent about his or her fees. And, don’t worry about having to write a big commission check as commissions are typically paid from the proceeds of the sale of the home.

2. Buyer’s agent commission

Sellers are also responsible for paying buyer’s agent fees. This fee is negotiable, however offering less than the typical 2.5% commission is frowned upon by buyer agents, and will often result in your listing being passed over.

3. Escrow fees

The escrow fee pays the escrow agent, who coordinates the transfer of title and cash/wire. Escrow agents also keep the property being sold in trust during the “escrow period,” while the sale is being finished and all inspections are completed and resolutions are agreed upon. Escrow fees usually cost about $2 per thousand dollars of the sale price, plus $199 – $249. Check out escrow services in California.

4. Title search fees

A title search fee pays for a specific document that proves you have a legal right to sell your house and insures the buyer if you don’t. The title search fee can run from $249 – $799 and will depend on what county your property is in.

5. Mortgage loan – balance payoff

At the close of escrow, prior to receiving any proceeds from the sale of the house, the remaining balance owed on your mortgage will be paid off to the lender. The mortgage loan balance payoff is the cost of repaying your home loan. It is important to note that this cost can sometimes include a loan payoff fee, which will vary by lender and may include a pre-payment penalty fee if described in your mortgage.

6. Closing cost concessions

There are some buyers who ask a seller to cover their closing costs. If you agree to their request, you will pay their fees, which could be in the range of approximately 3% of the home purchase price.

7. City and/or county transfer fees

The total cost of the city and/or county transfer fees will vary by location, county and in some areas, there are no transfer fees.

8. Miscellaneous Seller Closing Costs in California

In addition to what’s noted above, common standard closing costs for sellers in California, there are some additional miscellaneous costs and fees associated with selling your home. Not all of these will apply to you, however you should understand and be aware what these costs are before you get into the process.

9. Notary fees

Standard in a majority of legal processes, notary fees are paid to a notary who will verify your identity and ensure the proper execution of documentation.

10. Home Owner’s Association (HOA) transfer fee

The HOA transfer fee only applies if the said property you’re selling has an HOA. It’s typically paid for by the seller, and will include a fee to cover the document preparation from the current HOA and to register the new buyer as the property owner. HOA transfer fees are normally less than $1,000.

11. Cost of a home warranty

The home warranty is a common closing concession which is provided by the seller for the buyer. (It actually helps to protect you as a seller). The cost varies based on location and warranty company and can range anywhere from $249 to $999 based on if said property is a condo/townhome or single family residence, has a pool/spa, etc.

12. Termite inspection fee

The termite inspection fee is common in California and may be required depending on property location and the type of loan a buyer is using. A termite inspection fee usually costs $75 – $100. Depending on the inspection results, subsequent repairs can be anywhere from a few hundred to several thousand dollars. Typically the seller pays for section 1 repairs (active problems).

13. Natural Hazard Disclosure

This is a regularly ordered disclosure report which details natural hazards or threats in your location, such as earthquake fault lines and flood zones. The disclosure report often times includes other nuisances such as airplane noise. The disclosure will probable cost around $125 – $175.

14. Lien release document fee

If a court judgment which resulted in a lien on your property for any unpaid debt, you’ll need to repay it before your sale can close escrow. The lien release document (also known as a Release of Lien or Lien Cancellation) stating any said lien against your property has been paid will most likely be required. You will possibly also have to pay the recording fee on the document showing said debt has been paid in full.

15. The Bottom Line

This should address the question… How much are the seller closing cost. Many homeowners find that selling a house can be quite stressful. The cost of selling a house in California can be a bit daunting to anyone who hasn’t gone through the selling process before. There’s a lot of moving parts, but knowing what to expect and how to calculate your bottom line at the end of the sale can help eliminate some of that stress. Keep in mind, there is more to it than just subtracting your mortgage from your final sales price. As a home seller, you may be required to cover the costs of the lender payoff fees, commissions, escrow, title, property taxes and more. It pays to be educated on the whole process.

If you’re thinking about selling and putting your house on the market, and are curious just how much closing costs are for selling a home in California, you should learn about all options before making a commitment to an agent. Real estate can be a wise investment, and if you’re educated about it, you could walk away with a solid nest egg to reinvest into another property or investment which will benefit your overall financial state of well-being.

Interested in buying or selling a home?

We’ve enhanced the traditional real estate model with current and modern technology to improve the quality of the home buying/selling process.

Get in touch today. Contact us at 805-300-1626 or fill out the form below.