Welcome to the Monthly Market Report for May 2022. We want to give you the insights that you need to help confidently make the best decisions when buying and selling a home. We are your real estate advisors.

Based on the current estimate for the peak Fed Funds rate (3.25% to 4.0%), the 30-year fixed mortgage will likely peak at between 5.0% and 5.7%. There is some variability in the relationship, so we might see rates as high as the low 6% range. (This all depends on inflation and the Fed Funds rate – but I don’t expect rates to move much higher than the current rate – although 6% is possible).

Bill McBride, Author, Calculated Risk Blog

Here are the 3 most important takeaways you need to know right now:

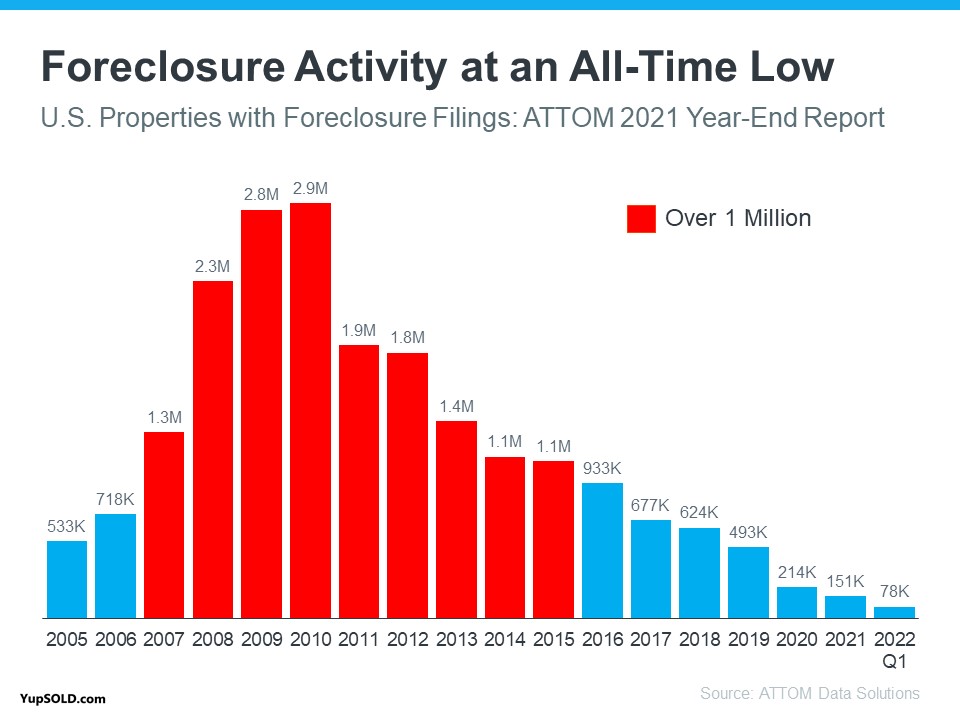

- Home Foreclosures – The number of home foreclosures is at a historic low.

2. Mortgage Payments – Rising rates and prices could greatly impact the monthly payments of homebuyers.

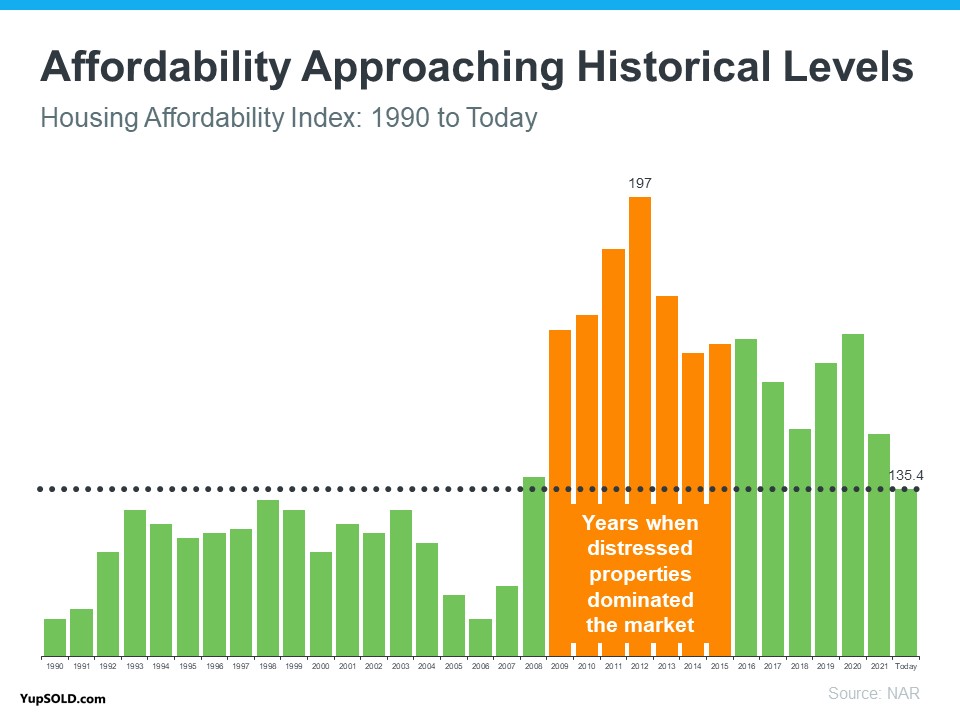

3. Affordability – The Home Affordability Index is declining closer to historical levels.

Read all the details and download your complimentary Housing Market Update for May 2022 now. 👇

Curious what the payment will be on your next home? Calculate it now.

“Get the facts without the pressure”. Let’s connect 😉 📧